Of FanDuel Group’s 350,000 sports betting customers, 42% have migrated from their daily fantasy sports database, the company announced Thursday as part of its 2019 financial highlights.

FanDuel also reported that online casino revenues tripled in the fourth quarter of 2019. FanDuel “materially benefited from sports betting cross-sell,” a company spokesman said, while a $60 million investment in marketing in the U.S. also played a role. (So did an employee total that has now surpassed the 1,000 mark.)

The company share of the online sports betting market in the four states where FanDuel Sportsbook is present — New Jersey being the pioneer in 2018, followed last year by Pennsylvania, Indiana, and West Virginia — is 44%, the company says, with “the leading position” in each state. (Numbers released by the Indiana Gaming Commission, however, show that DraftKings still leads FanDuel in that state.)

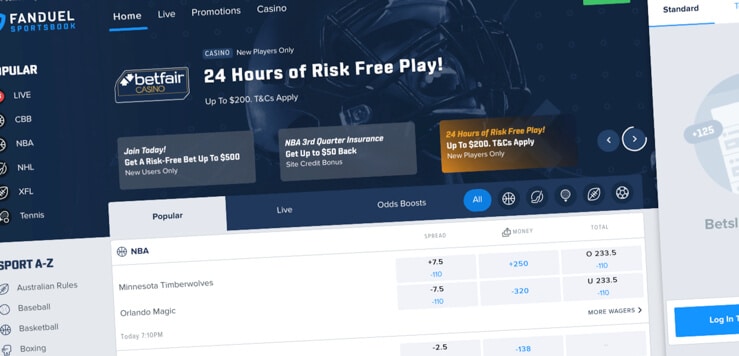

FanDuel Group is more than just DFS — and now sports betting and online casino games. The subsidiary of Flutter Entertainment, which is part of the FTSE 100 index on the London Stock Exchange, also has a sibling in Betfair US and in horse racing industry giant TVG.

“Cross-sell between these products materially lowered acquisition costs and increased customer retention,” the company announced.

FanDuel Sportsbook expands its brand

FanDuel Sportsbook, with its brick-and-mortar flagship at the Meadowlands Racetrack to go along with the online product, produced 54% net revenue growth in 2019 for the group, which reported net revenue for the year of $480 million.

While the 14 states with legal sports betting represent a mere 24% of the population, FanDuel estimates that 23 more states — representing another 44% of the U.S. population — “have active online sports betting or casino bills in progress.”

The company pronounced that it “expects to go live” in 2020 in Tennessee, Iowa, and Colorado.

The “addressable market” — or potential demand — for FanDuel’s “four verticals” of DFS, sports betting, online casino gaming, and horse racing now “exceeds $10 billion per annum.”

“We are proud of our second successful year since the launch of legal sports betting in the United States,” said FanDuel Group CEO Matt King in a statement.

New Jersey got the ball rolling back in Nov. 2011, when its residents overwhelmingly approved a referendum on whether to bring Las Vegas-style sports betting to state racetracks and to Atlantic City casinos. After a six-year legal battle with five major sports organizations including the NFL, the state prevailed when the U.S. Supreme Court in May 2018 vacated a 26-year-old law restricting almost all such gambling to Nevada.

Flutter’s worldwide plans in 2020

Dublin-based Flutter’s announcement on Thursday explained that the company’s worldwide online gaming revenue growth was 18% in 2019 compared to 11% the year before.

“While executing on our strategy remains a key focus, it is important that we reflect on the future direction of our business and the sector more broadly,” a company spokesman said. “Our Group operates in a fast-paced, highly competitive industry that is governed by a multitude of national regulatory and tax frameworks which are continuously evolving. Regulatory change presents the Group with great opportunities but also poses real potential challenges and risks. To be well positioned to deal with such change, we believe that global scale and diversification are key.

“In 2019 we saw examples of both. The expansion of the regulated sports betting market in the U.S. continues apace, an opportunity that we believe is transformational for the Group. In our core markets of the UK, Ireland, and Australia we also incurred significant tax increases while our international operations experienced several unexpected market closures in the first half of the year.”

Flutter CEO Peter Jackson said:

“Our online market share during 2019 of 44% in the states where we have gone live is testament to the quality of our products, brand, and team. We remain as confident as ever in the size of the prize in the U.S. and in our strategic approach which positions us well for the future. The new financial year is off to a strong start with good momentum across all our brands. We are very excited about the Group’s prospects and in particular our proposed combination with The Stars Group, which will help us to build a more diversified global business.”

The Stars Group, based in Canada, operates online brands such as PokerStars, BetStars, and Full Tilt Poker. The company changed its name from “Amaya” in 2017.

Flutter laid out its strategy for growth in the U.S.:

“We continue to believe that certainty of market access in each state is key, ideally via ‘first skin’ access agreements. First skin refers to having the right to use the first online/mobile license that a land-based partner is granted in a particular state. Some states have only granted one skin per operator, for example Michigan, which is why securing first skin access is a priority.

“We recently secured additional first skin market access deals with The Cordish Company in Maryland and Twin River in Colorado. We now have first skin market access deals in 15 U.S. states. Looking ahead, we believe that the strength of our market share performance to date will make us an attractive potential partner in further states.”